Planning for retirement can feel daunting, but the American Funds 2045 Target-Date Retirement Fund (AAHTX) offers a potentially simpler path. Designed for those aiming to retire around 2045, AAHTX provides a professionally managed, diversified investment strategy aimed at balancing growth and risk mitigation as retirement approaches. For more stable, low-risk options, consider exploring government money market funds. This deep dive will explain how it works, highlight its advantages and disadvantages, and help you determine if it aligns with your financial goals.

How the AAHTX Fund Works: A Strategic Approach

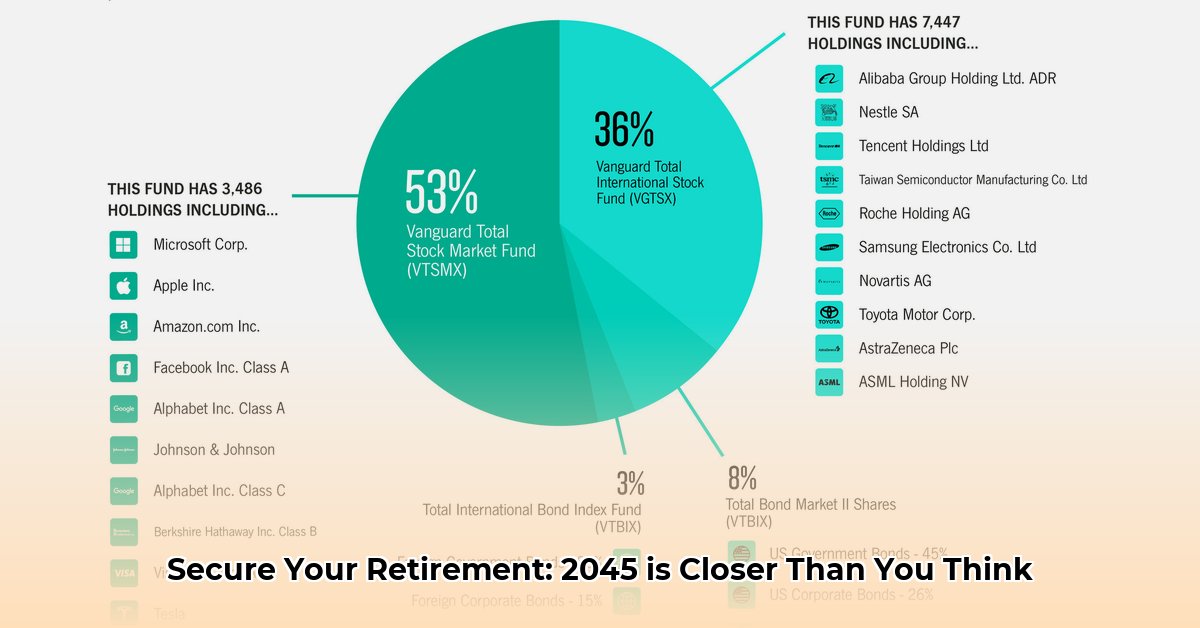

AAHTX employs a diversified investment strategy, spreading your investments across various asset classes, primarily stocks and bonds. The fund's asset allocation dynamically adjusts over time, a strategy known as a "glide path." Initially, a larger proportion is invested in stocks for potential growth, gradually shifting toward a higher percentage of bonds as 2045 approaches, aiming to preserve capital and reduce risk closer to retirement. This shift is managed by experienced investment professionals who actively monitor market conditions and make strategic adjustments to optimize performance. Think of it as a professionally guided journey towards your retirement destination.

Isn't it reassuring to have experts managing your investments? The fund's strategy aims to smooth out market volatility without sacrificing potential long-term growth.

Advantages of AAHTX: Maximizing Your Investment

AAHTX presents several key advantages for prospective investors:

Low Expense Ratio: With a relatively low expense ratio of 0.69%, more of your money is dedicated to growth, not fees. This is a significant advantage in the long run. How many times have you heard that small fees can add up? This fund minimizes that cost.

Expert Management: Benefit from the expertise of seasoned investment professionals who continuously analyze the market and adjust the fund's holdings to potentially optimize its performance. You'll have professionals working for you, aiming to protect your investment.

Diversification: The fund's diversified portfolio across numerous asset classes and geographic regions helps to spread risk, mitigating the impact of potential losses in any single sector or market environment. This is an extremely important aspect of a successful investment strategy. It's about reducing risks, not eliminating them.

Simplified Investing: Instead of selecting individual investments, AAHTX provides a convenient single fund solution for your retirement savings, simplifying the investing process.

Understanding the Potential Risks: A Realistic Perspective

While AAHTX offers many benefits, investors should be aware of potential risks:

Market Volatility: Like all investments in the stock market, AAHTX is subject to market fluctuations. The value of your investment can go up and down.

Interest Rate Risk: Changes in interest rates can impact the value of bonds within the fund. Rising interest rates may cause the value of those bonds to decline.

Inflation Risk: Inflation erodes the purchasing power of money over time. This means your retirement savings might not buy as much in the future as they do today.

Credit Risk: As a bondholder, you stand a risk of a company defaulting and you not getting your investment back.

It's important to remember that no investment guarantees a specific return. What is guaranteed is the importance of planning and regular monitoring.

AAHTX Compared to Alternatives: Finding Your Right Fit

AAHTX is one option among many for retirement planning. Comparing it to other target-date funds or independent strategies requires considering your risk tolerance, time horizon, and investment goals. AAHTX's low-cost structure and professional management are key advantages, but thoroughly research alternative solutions to find the best fit for your specific needs.

Who Should Invest in AAHTX?

AAHTX is well-suited for investors approaching retirement around 2045 who:

Prefer a passive approach: This is a relatively hands-off investment strategy.

Value professional management: This fund is great for those who don’t have the time or expertise to manage their own portfolio.

Have a moderate risk tolerance: AAHTX is designed to balance growth and risk over time.

Seek simplicity: It's a "one-stop shop" for retirement savings.

The Bottom Line: A Strategic Step Towards Retirement Security

AAHTX offers a convenient and potentially valuable retirement investment strategy. However, it’s crucial to understand the inherent risks and align your investment choices with your financial goals and risk tolerance. Before making any investment decisions, consult with a qualified financial advisor to ensure AAHTX is the right fit for your unique circumstances. They can provide personalized guidance and help create a comprehensive retirement plan. Remember, a well-informed decision is the cornerstone of successful retirement planning. This is a journey, not a race; make sure to plan strategically.